| #1: Check Your FICO Score with a Credit Report First things first – you need to see exactly where you are at with your credit score. If you don’t know where you are, you can’t get to where you want to be with improving your credit rating. Once you know your FICO score, you can create a plan to improve your credit score more easily. Once a year, request a score from the top three bureaus – Experian®, Equifax®, and TransUnion®. #2: Pay Your Bills on Time Every Time This is probably the most important thing you can do to improve a credit score. Not doing this severely impacts your credit score. If you haven’t been keeping up with your payments, it’s likely that your credit score has dropped substantially. |  |

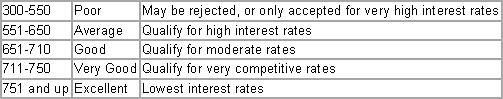

Here’s a brief rundown of FICO Credit Score ranges (estimated – will vary between companies):

#3: Actively Use One or Two of Your Best Cards, Forget the Rest (but don’t close them out)

If you are have a low credit score and are having debt problems, this will require a great deal of willpower to change your habits. Don’t spend anymore on those additional cards. And if the cards that you are actively using are reaching their limits, that means one thing – you need to spend less and budget your money better – and starting paying in cash. This will be temporary until you can get out your bad spending habits.

If you have an average credit score and aren’t in dire straits with debt, you may want to spend mainly on one or two cards, and occasionally spend on any other credit cards you have. Just don’t forget to make those payments on time! The reason for keeping those additional cards open is for maintaining a higher utilization limit.

So what is credit utilization? It is the total limit of all of your cards combined, which is how much you are able to spend. If all of your cards are maxed out, then your utilization would be close to 100% – not good. However if you have low balances, your utilization will be lower. Say you have a total limit of $20K between all your cards and only have $2K in balances – your utilization is only 10%- that’s good. If you close a card and drop your utilization to say $10K, your utilization would immediately increase to 20%. That’s why you need to keep the credit cards open for the time being to maintain a lower utilization.

#4: Don’t Push Your Cards to Their Credit Limits

If you are having an issue maxing out a particular card with a lower limit, try to spread your spending out across another card. It’s better to keep the utilization down on each card to help improve your credit rating. Shoot for 25%-30% or lower with your utilization rate, even if you are consistently paying them off in full every month.

#5: Reduce Your Credit Card Balances All You Can

A recap of a detail in Point #1 but important to mention again. The more you can pay down those balances, the less interest will accrue for your debt management issues and the lower your credit utilization will be. As stated above, lower utilization should help increase your credit score quickly. And that’s less debt to worry about, and more money in your pocket and not in the pocket of the credit card companies or lenders.

#6: Don’t Apply for Too Many Credits Cards or Loans:

Each time your credit score is checked by a credit or loan company, you could potentially lose points from your FICO score. If you need to do it, it’s better to apply over a short period of time, say a 2-3 week period. Clusters of credit inquiries aren’t so detrimental; it is when queries occur over a longer period of time. If you’re already having debt problems, then you don’t need to be looking into more cards or loans – you should be focusing on settling credit card debts and loan debt already. Part of how you got here is by overextending yourself with debt.

If you are managing your money well, but have just been a bit lazy with paying on time, or not paying attention to your credit score, now’s the time to tighten up and stop making those sloppy mistakes. This way, you’ll get better APRs and rates for everything. This will definitely help you not only with credit card rates, but also mortgage rates if you’re in the market for purchasing your own home or a refinance.

#7: Get a Secured Credit Card

This is very useful to someone who has a low FICO score. A company offering a secured credit card will require you to place a deposit of several hundred dollars down or whatever the company requires. This secures the card in case you have trouble with payments.

#8: Dispute Any Possible Errors or Mistakes

Occasionally, mistakes will appear on your credit report. If you didn’t do anything to open a new account or have any new inquires made, you can certainly ask to have them removed. Also if you happened to miss some payments because you simply forgot to pay on time, most companies are quite forgiving when it comes to removing them. Go to your credit card company or lender directly and ask that it be forgiven. Of course you must pay on time the next time, but generally this is easy to do.

Armed with the above information, there’s no need to keep wondering “how can I improve my credit score?” With the above suggestions, you should be able to form a plan of action to improve your credit in both the short and long term.

First Capital - A mortgage Company 1-818-458-0010

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.